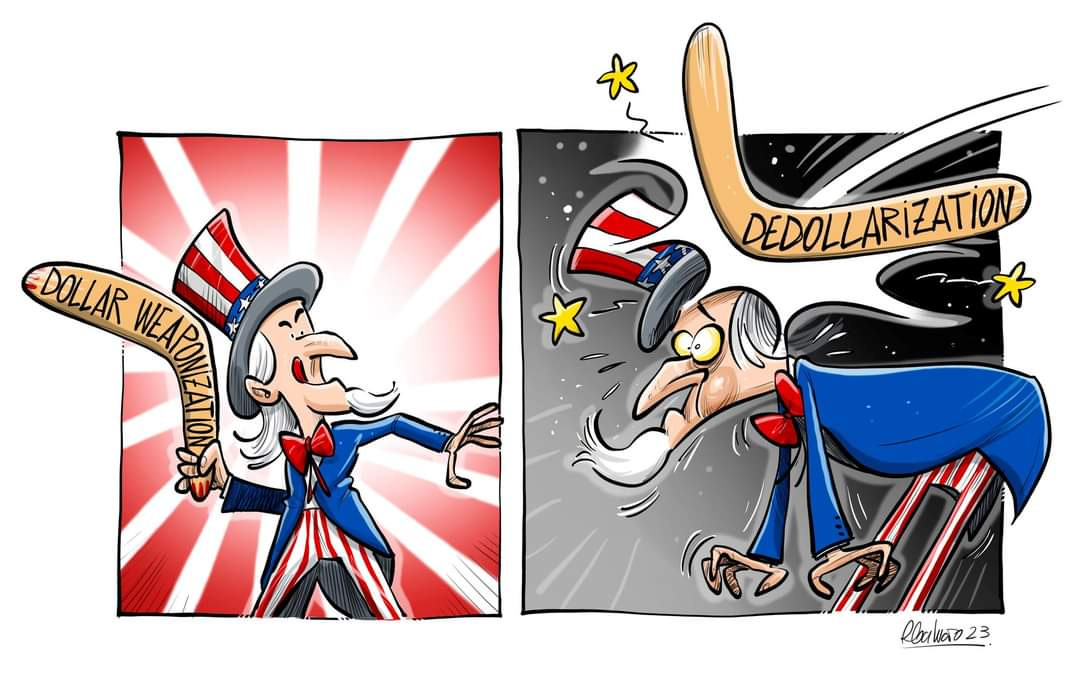

Today's conversation between Putin and President and Chairman of the Board of the Bank VTB Andrei Kostin centered on two important developments--transfer of government shares in the United Shipbuilding Corporation to the bank so it can become more directly connected to the financing and financial management of that strategic state-owned corporation that I see as a creative, unique method of problem solving. And the second is Kostin's update on the dedollarization situation centered around the use of national currencies in transactions and the related building of infrastructure to support those transactions, which as most readers know I see as key to the entire process. Here is that part of their conversation:

Putin: Well, the second issue – we have discussed this many times-is related to the organization of a settlement system for foreign trade operations, the transition to national currencies, and so on. I know that you have also done a good job here, including with the Bank of Russia.

A. Kostin: As you know, in recent months there has been a very active development of bilateral settlements, and if at the initial stage Russia was the main initiator of these processes, now these processes have already gone beyond communication with Russia.

We also know that the largest Asian countries, such as China, India, Indonesia, Arab countries, especially the Persian Gulf, and Saudi Arabia… And at the Russia-Africa summit, we had a lot of contacts with African representatives, and they also told us that these processes have started in Africa, and African countries are starting to pay each other in national currencies and, importantly, create new infrastructure. In particular, SWIFT is being replaced by systems that replace it and are created by these countries themselves.

I think that one of our tasks today is to combine these systems. Because everyone has developed their own – the Chinese have it, the Hindus have it, and we have it - but it's important that they can interact with each other. I think this is a very important point.

In addition, direct correspondent accounts are being established between banks, and payments are already being made in national currencies.

We are also promoting the idea of creating a settlement and depository hub to replace Euroclear. As you know, Euroclear compromised itself by freezing huge funds, including Russian citizens, today. But many States, and we have spoken with several Gulf States, are ready to host such hubs in order to create an alternative. And this is not directed against anyone, it is just an alternative option that will be devoid of any political or other restrictions.

And in this regard, we are working. I think that, of course, the largest partner is China, and we need to work with it at all levels, and at a high political level. But there is also movement there, including through our central banks.

Of course, new digital technologies offer great opportunities. The digital ruble is being launched under the leadership of the Central Bank, and 13 banks are participating in it – this is no longer an experiment, it is already, in general, the introduction of the digital ruble into practice. We know that there is a digital yuan. I think that this will be a big step forward in advancing our bilateral settlements.

And the same digital systems are gradually being created and developed by other countries. Therefore, I think that this year and next we will see a rapid transition to payments in national currencies in the countries of what we call the global south, that is, in developing countries, countries that are friendly to us today. And we are working very hard on this, of course.

Vladimir Putin: So the bank is also moving in this direction?

A. Kostin: Yes, we also have a network, as you know, there is a bank in Shanghai and Delhi, and we, of course, work very actively with the Gulf states – in general, there is traffic everywhere.

Vladimir Putin: Good. Thank you. [My Emphasis]

Promising and exciting news. Having financial sovereignty means having the ability to avoid illegal sanctions which spells their demise and the hegemony of the states that wield them. As Kostin said, building this network will take time, but once built digital national currencies will be able to flow without fear of choke points and overall turnover in global commerce will increase.

Like what you’ve been reading at Karlof1’s Substack? Then please consider subscribing and choosing to make a monthly/yearly pledge to enable my efforts in this challenging realm. Thank You!

simplicius had a very good article up discussing russia banking system and finance, in case anyone missed it.. https://simplicius76.substack.com/p/russias-cbdc-exploring-the-truth

further to all this, i see no mention of pakistan which makes sense given the news of late regarding imran khan, specifically the not so subtle usa pressure to get him to conform with usa-nato agenda in ukraine... i find this all so very interesting..

Good. Unfortunately I don't have a good enough understanding of such matters. In particular I'm ignorant on the related debate that occurred recently in MoA columns. Something about the USA debt and the utility/danger of printing money and increasing that debt. I think. As best I can make out.

It seemed to me that one party to that debate was arguing that a sovereign nation like the USA (with a dollar hegemony the only sovereign nation in this respect, really) really never has any debt because it is in a position to simply buy that debt itself and cover it by making more money. ie. doing things that normally would cheapen a currency and weaken the nation. Doesn't happen to the USA because everyone always needs their money and they don't need anyone else's.

I don't know.

An essay by Karlof explaining this would be nice.