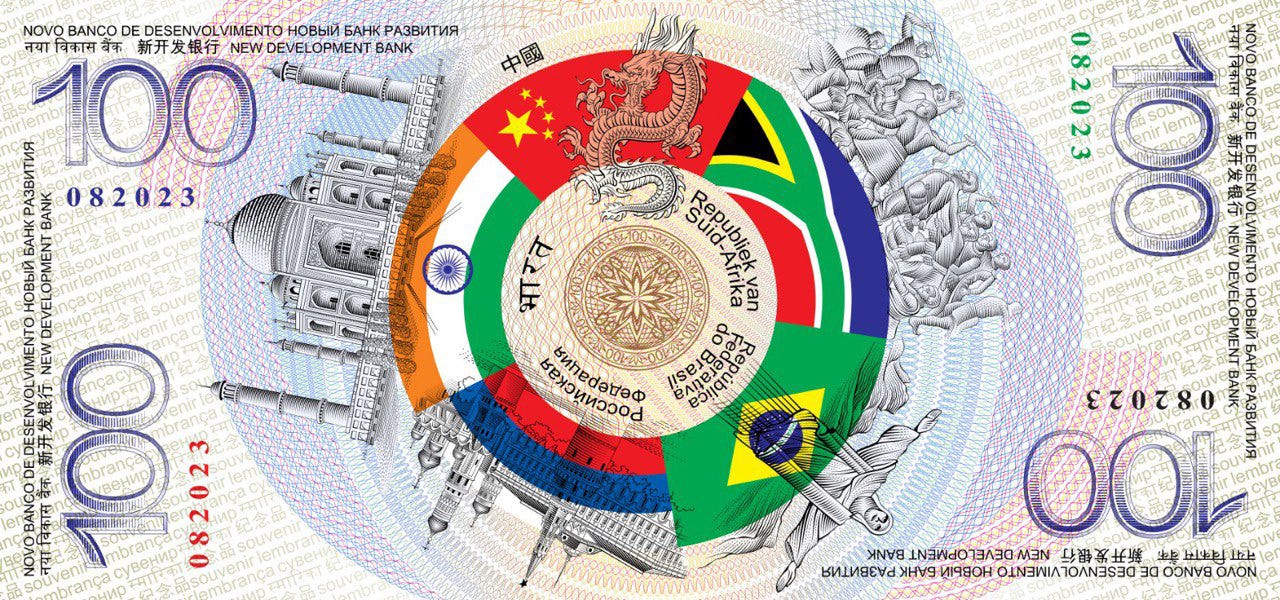

Dedollarization Update: BRICS' SWIFT

Timur Aitov: The new BRICS initiative should be welcomed

At the International Affairs magazine’s website, Timur Aitov, Chairman of the Commission on Financial and Information Security of the Council of the Chamber of Commerce and Industry of the Russian Federation, shared his expert opinion on the matter of BRICS having officially announced the creation of a financial system similar to SWIFT. The format is almost didactic as if Aitov is giving a lecture and the writer is providing verbatim notes that some readers may find cumbersome. I decided to leave it as is with all emphasis being mine:

"Problems with cross-border payments today are of concern to everyone, not only professionals. Numerous delays reported by the media lead to downtime, failure to meet the deadlines for the shipment of goods, and refusal to deliver. Logistics costs are rising, payment commissions are increasing, and risk assessments of possible losses are growing – all this is reflected in the prices of goods. For example, every percent increase in fees for cross-border payments leads to losses of more than $1 billion (this is with total exports from China of $110 billion in 2023). The real losses of the business are much higher, and in most cases, SWIFT has nothing to do with it at all. Nevertheless, payments remain a source of many problems, and the new BRICS initiative should be welcomed," the expert said.

"Nevertheless, it is not yet clear what exactly is meant by the "analogue" of the SWIFT system. The fact is that the existing international SWIFT is not actually a payment system, but only a system for transferring financial messages: a kind of specialized electronic document management system, nothing more. In reality, payments go through completely different channels. In China, for example, there is its own national SWIFT, which performs both functions simultaneously - both the functions of a payment system and a system for the transfer of financial messages. The Chinese system works in yuan, and Chinese banks use it. It will be possible to concretely assess the new BRICS project when a concept note appears - a description of the project on paper. However, today we can be sure that there will be no insurmountable technological difficulties in the implementation of the project," said Timur Aitov.

"Nevertheless, bottlenecks will still remain. We should expect problems with fears and fears of falling under secondary sanctions. There will also be problems related to the efficiency of the system as a whole. What, in fact, will be a means of payment in this "analogue" of SWIFT? As far as I understand, the BRICS abandoned the single currency, and now only the use of the CRC is being discussed, a digital clearing unit of account based on a basket of non-convertible currencies of the BRICS countries. In relation to it, there are questions both about the efficiency of use and about the most controversial point for today - the composition of the currencies of the basket," the expert said.

"I note that analogues of SWIFT, of course, exist in the world, they have existed in the past. Let me remind you that even in the USSR there was a successful experience of creating payment systems for associations such as the Council for Mutual Economic Assistance (CMEA) - in this system, the transferable ruble was used to pay for goods and services. There was no special digitalization and blockchain at that time, but the system worked successfully. Settlements of the COMECON countries using the transferable ruble implied multilateral clearing - the country's import debt was covered both by counter exports and by deliveries to third countries. There was a specially created International Bank for Economic Co-operation (IBEC), which issued supranational currency and gave loans at 1.5%. The national currencies of the COMECON member countries were retained - the Bulgarian leva, German marks, Polish zlotys, Czech crowns, etc. According to historians, the initiative to create a supranational currency came personally from Stalin, it was on his instructions that the foundations of settlements based on the transferable ruble were developed in the fifties. The current geopolitical situation is reminiscent of the recent past: reliable cross-border settlements have become possible only in a closed loop, using the transferable ruble and in friendly CMEA countries. All the words are important here - both that the contour is closed, and that the countries are friendly. Unfriendly countries could not accept the transferable ruble at that time. Let me remind you that the gold content of the transferable ruble was significant - 0.987412 g of pure gold," said Timur Aitov.

"Of course, there are other tools that are guaranteed to allow you to "circumvent" sanctions. There are general considerations and recommendations in this regard. For example, large financial communication structures (such as SWIFT and the like) are noticeable, so they are easy to turn off, while small ones do not have enough users. In the new realities, it is reasonable to move towards decentralized technological solutions — small distributed technological infrastructures — when designing. In this case, the phrase "distributed structure" has nothing to do with blockchain, that's not what we're talking about. Rather, it is a system of "microswifts" – a kind of bricks that, like a Lego constructor, can independently be combined into groups, having their own local standards. The cubes should be such that it is possible to provide a flexible configuration of the entire system as a whole, while guaranteeing the impossibility of isolating or disconnecting from the services of any member of the bundle. This area is important not only for countering sanctions. For example, such a scheme will make it possible to create local communities within a single global payment platform, but with their own rules. For those Muslims who may have additional restrictions in finances," the expert emphasized.

"As a counteraction tool, there are numerous proposals to create some kind of "gaskets" in cross-border payments - in the form of "proxy exchanges", with cryptocurrency trading between business representatives. In such schemes, crypto essentially acts as a digital tool for securing barter transactions. However, alas, there are already examples when sanctions bans reached such pads. It seems that the special services of enemies control the processes in the crypto world well. This, by the way, is a possible explanation for the history of the emergence of crypto instruments - where did crypto come from in general and who was its progenitor. In general, the idea of creating payment systems with "covering your tracks" is not so simple and, on closer inspection, does not save settlements in fiat currencies just because the latter are eventually terminated in bank accounts. It is a closed circuit that is required, where foreign regulators or transnational banks, as a kind of financial intelligence officers, are no longer allowed," Timur Aitov said.

"If there are many opportunities and paths, then what is the right way to move forward? To make a huge full-scale system of mutual settlements of the BRICS countries, which will be in plain sight? Or should we start by focusing on "stealthy" bilateral point-to-point calculations according to the China-Iran scheme? There is no definite answer. In the current realities, it [BRICS] is forced to create duplicate channels for payments, communications, and even individual services. This, of course, is not very cost-effective, but it reduces the risks of blocking, denial of service, and other unpleasant problems. Which is better – a point system of bilateral settlements according to the China-Iran scheme or a huge system like SWIFT with numerous participants – the answer is ambiguous. A large-scale system is more convenient, more functional, and has lower costs per operation, on the other hand, it is, as we have seen, more visible. At the same time, I even admit that China and Iran are also highly effective in mutual settlements and are so well "accustomed" to the subject area that they have very small costs for organizing mutual payments," the expert said.

"I am sure that the success of the new BRICS project will not be ensured by technology or even the large-scale participation of political forces, associations and governments. Success is based on the moods, aspirations, and ideas about their future of the broad masses of the people of the overwhelming majority of countries of the world. Everyone is tired of the undivided hegemony of the Anglo-Saxon world. The world has changed and cannot remain the same. Nevertheless, of course, much depends on the activity of politicians. No technology will solve geopolitical problems in the sense that the problems are primary," Timur Aitov summed up.

Perhaps that was more confusing than helpful. Aitov appears to favor the “microswifts” approach, which is somewhat similar to my conceptualization where both large and small are combined yet are separate as sit’s possible for nations to be individually connected yet still function as part of a larger organization, a development bank, for example. Messaging and transmittal of payments are thus two separate operations with the latter having greater importance. So, as noted, duplicating SWIFT is simple; what’s complex is the routing of settlements that must avoid unfriendly choke points. Again, with digital systems, this ought to be rather simple as each nation’s bank can be digitally connected. If COMECON/CMEA nations were able to construct and use their own system without digital tools, then there’s nothing to deter BRICS from doing the same. The problem comes with the complexity of trying BRICS+ members together since they are often separated by oceans whereas COMECON/CMEA were all located in one geographic block.

The key to dedollarization is the total curtailing of dollar usage in all aspects, which will be difficult because many billions in loans—the vast majority being odious—are denominated in dollars. 100 years ago, the Outlaw US Empire would invade any nation that fell behind or defaulted on its loan payments, but it hasn’t used that as a pretext for awhile. Most nations are now aware that their reserves aren’t safe in any Western bank and are repatriating them as best they can. Russia has already proposed a BRICS Grain exchange, which can be expanded to include other commodities. Such an exchange would remove the dollarization of commodity pricing and remove the Empire’s commodity market from the ability to manipulate prices, which would result in lowering prices to the Global Majority while raising them is dollars as it continues to weaken because of its relative worthlessness. If dollars aren’t needed to by commodities, then the demand for dollars falls as does its value, which results in inflation within the Empire reflecting the fact that it’s $35+ Trillion in debt.

So, what might be announced in October at the BRICS Summit at Kazan? So far, a very tight lid has been kept on the monetary system developments; less so on the formation of a commodity market. IMO, the commodity market will be announced with its location in Shanghai. It’s more likely the initiation of regional miniswifts will be announced versus the larger structure. I also believe there will be an announcement of further capitalization of the BRICS Bank with perhaps the opening of another branch. I’m sure more news will be leaked over the coming weeks to report upon.

*

*

*

Like what you’ve been reading at Karlof1’s Substack? Then please consider subscribing and choosing to make a monthly/yearly pledge to enable my efforts in this challenging realm. Thank You!

Unit value of something needs a better explanation or at least an improvement of my understanding. 0.987412 g of pure gold is something anyone can understand.

The time value of money is another, e.g. interest per unit time. Messaging and actual transfer as separate transaction is something that has to meet the needs of the participants. I can use EFTs as a single transaction but financial systems may have very different needs. Wire transfers are instantaneous, i.e. milliseconds, just like computerized messaging systems, in use worldwide for moving goods through customs fort example. I have designed a few of those, moving money as well.

"The key to de-dollarization is the total curtailing of dollar usage in all aspects, which will be difficult because many billions in loans—the vast majority being odious—are denominated in dollars”.

China has $5 trillion in foreign reserves, says Brad Setser, and Beijing is offering friendly countries with big dollar debts to swap their USD loans for RMB loans on better terms.