This quote comes at the end of the 31st Geopolitical Economy Hour:

[T]hings are coming to a head, because the Federal Reserve can neither lower interest rates because of inflation, and if it doesn’t lower them, then the financial crisis will come, and nor can it raise them further in order to finish the job, because that will simply mean the financial crisis will occur sooner.

Although the talk was mostly about debt, it finally got around to dealing with the elephant in the room:

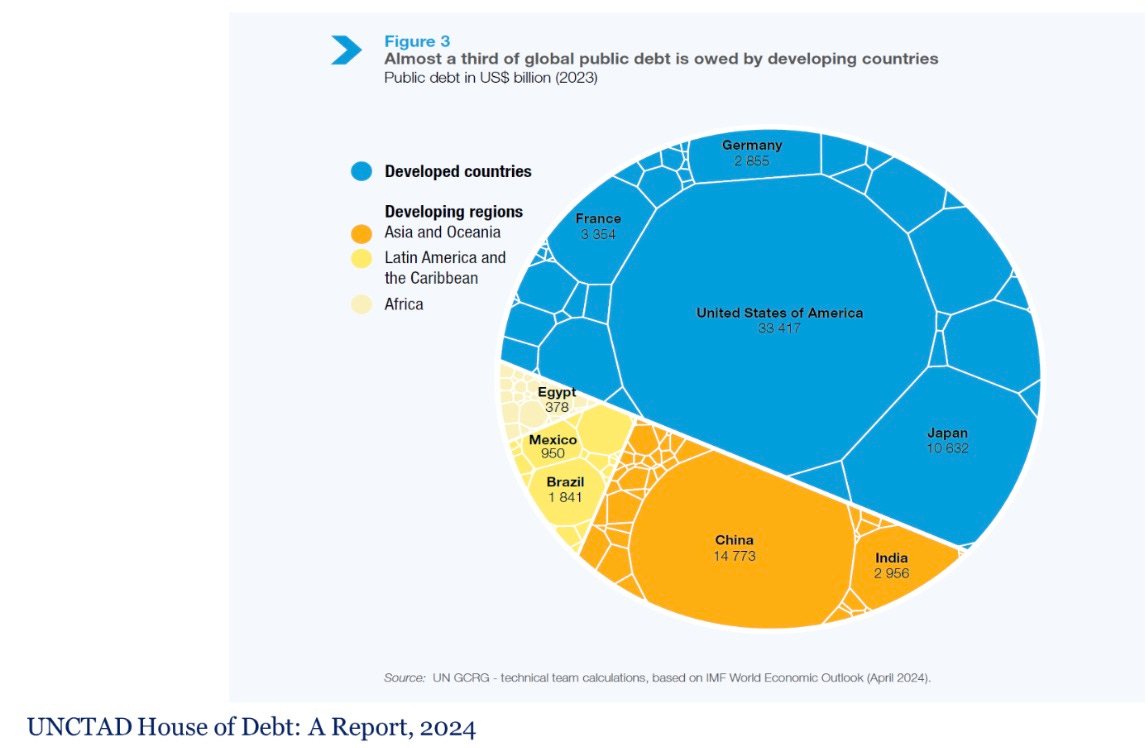

The above chart is one of several used in the discussion.

Yes, a third is owed by developing nations, but one nation has close to 2/3s of all debt: The Outlaw US Empire. Desai and Hudson promised to return to deal with that big blue splotch above which is well represented in the header photo (that film dealt with many very important issues) as most of that debt is related to all the wars initiated by the Empire since 1945, and especially since 1975.

The title Dr. Hudson chose for this transcript is “Quality of Debt Counts,” which might also be stated as “It’s Who You Know” thanks to the explanation of Ukraine being allowed to do things not allowed for other nations—in fact, there are several unicorns involved as you’ll discover. IMO, the transcript is worth reading just to get the lowdown on the whole Ukie debt and theft of Russian assets issues which are directly connected.

I have a large composition on the EU situation that’s unfinished at the moment. But I wanted to alert readers to this recent production and its interesting discussion for those not hip to the overall international debt issue whose solving involves the creation of a new system to replace the imperialist institutions born at Bretton Woods and long past their shelf-life.

So, as the opening citation suggests, we’re in limbo regarding the dysfunctioning dollar system. The only advice I have to offer for those of us within the Empire is to move your monies to a credit union as they operate under different and better rules than the Big Banks; otherwise, I don’t feel comfortable giving any dollar denominated investment advice. But I would buy Chinese bonds.

*

*

*

Like what you’ve been reading at Karlof1’s Substack? Then please consider subscribing and choosing to make a monthly/yearly pledge to enable my efforts in this challenging realm. Thank You!

GOLD.

All kinds of good reasons to put our money into credit unions. Here's another. Thanks for this important but scary info, Karl.